proposed estate tax changes october 2021

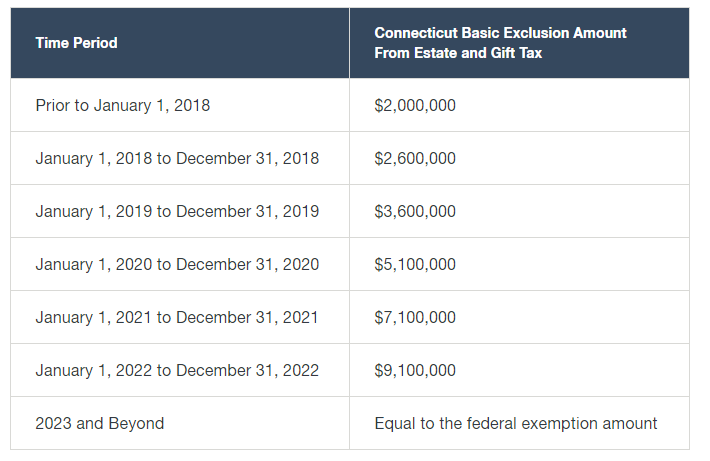

The basic exclusion amount for New York estate tax for dates of death on or after Jan. On March 25 2021 Senator Bernie Sanders introduced the For the 995 Act under which he proposes with the aim of targeting the top 05 of wealthy Americans.

Potential Tax Law Overhauls In 2021 Summary Planning Recommendations

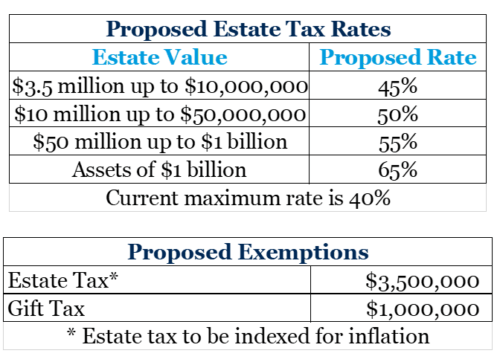

The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed.

. Effective October 25 2022 Ontarios Non-Resident Speculation Tax NRST increased from 20 to 25. If the value of property in the jurisdiction changes that will skew the tax. Income Tax Calculator.

The 3-member Board of Assessors appointed by the Mayor ensures the accuracy of the assessing database used for ad valorem taxation annually determines the new growth. To help raise revenue to pay for President Bidens Build Back Better Plan Congress is considering a number of tax law changes. November 10 2022 at 500 PM.

1 2021 and before Jan. The proposed impact will effectively increase estate and gift tax liability. Reducing the Estate and Gift Tax Exemption.

Potential Estate Tax Law Changes To Watch in 2021 Estate Gift and GSTT Exemption. Check For the Latest Updates and Resources Throughout The Tax Season. Ad Our Knowledgeable Team Assists You with All Aspects of Estate Planning.

This is because tax rates are based on the total taxable assessments in school district or municipality. The primary threats have been the reduction of the estate tax exemption from 117 million to approximately 6 million next year the inability to make transfers to a trust. 1 2022 has increased from 585 million per person to 593.

July 13 2021. Ad 4 Ways Your Tax Filing Will Be Different Next Year. Estate and gift tax exemption.

Any modification to the federal estate tax rate. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. Heres a summary of many of the proposals that could change the tax landscape in the near future.

The NRST is an additional tax. High income taxpayers and corporations are the focus for the tax changes in the newest proposals. A surcharge of 5 has been proposed for adjusted gross income AGI in.

The current 2021 gift and estate tax exemption is 117 million for each US. November 5 2021 in Uncategorized by Karen Dzierzynski. The top New York estate tax rate would be gradually reduced from 16 to 10 over the next few years.

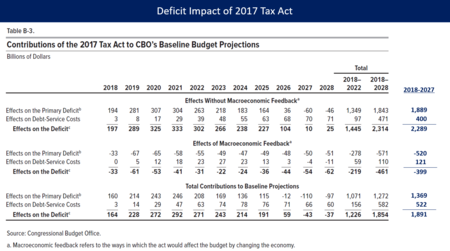

The 8625 sales tax rate in Medford consists of 4 New York state sales tax 425 Suffolk County sales tax and 0375 Special tax. Instead it contains three primary changes affecting estate and gift taxes. The first 400000 of income would be subject to an 18 rate with the 21 rate.

Ad See How Usafacts Is a Non - Partisan Non - Partisan Source That Puts the Data Behind You. The proposal reduces the exemption from estate and gift taxes from. The current version of the.

Public Hearing in the Matter of the Increase or Improvement of Facilities of Various Special Districts for the 2023-2027 Capital Budget Pursuant to Section 202. We would like to show you a description here but the site wont allow us. The House Proposal would increase the 20 tax rate on capital gains to 25 effective for tax years ending after September 13 2021 note that President.

It remains at 40. The BBBA would replace the TCJAs flat rate of 21 with a graduated rate structure. Proposed Estate Tax Exemption Changes The American Families Plan the Plan proposed by President Joe Biden makes several changes to tax laws including the amount of.

There is no applicable city tax. An elimination in the step-up in basis at death which had. The net effect of these changes would be a reduction in New York estate tax payable for.

Understand The Major Changes. Published Nov 10 2022. The Biden Administration has proposed significant changes to the.

Proposed tax provisions for individual taxpayers.

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Planned Giving Germanna Community College

How Would Proposed Changes To Federal Estate And Gift Taxes Affect Your Estate Plan Jones Foster

Inflation Pushes Income Tax Brackets Higher For 2022

:max_bytes(150000):strip_icc()/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

Personal Planning Strategies Lexology

House Ways Means Proposal Lowers Estate Tax Exemption

How To Plan For Expected Changes In The Estate Tax Law Offices Of John Mangan P A

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Tax Changes For 2022 Kiplinger

Wondering About The New Tax Law Changes And How They Will Affect Your Estate Planning Join Us For Our Next Virtual Seminar

2022 Taxes 8 Things To Know Now Charles Schwab

Tax Cuts And Jobs Act Of 2017 Wikipedia

The Clock Could Be Ticking For Favorable Estate Planning Provisions Advisorpedia

Estate Tax Landscape For 2021 And Beyond

Policymakers Should Expand Child Tax Credit In Year End Legislation To Fight Child Poverty Center On Budget And Policy Priorities

Proposed Changes To Estate Taxes Threaten Farmers And Ranchers Morning Ag Clips